What is Bitcoin Dominance?

Key Takeaways

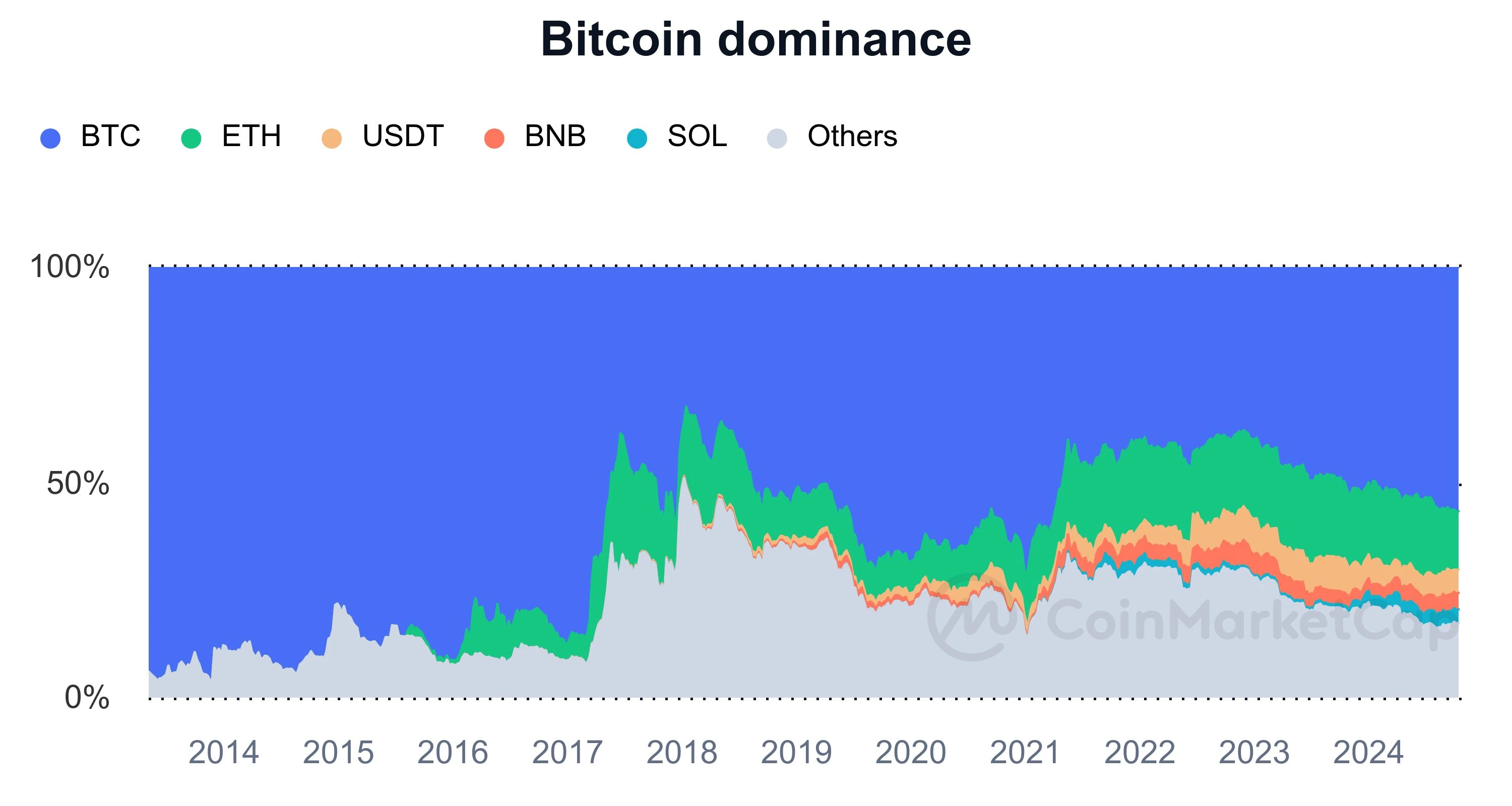

- Bitcoin Dominance measures Bitcoin's market cap against the rest of the crypto market's value.

- High dominance suggests a weaker altcoin market.

- Low dominance suggests a stronger altcoin market.

Bitcoin Dominance is a metric used to define the share of Bitcoin’s market cap compared to the rest of the crypto market.

For example:

Let’s say the value of all Bitcoin is worth $9 trillion while the rest of the crypto market was worth $1 trillion.

That would put Bitcoin Dominance at 90%, because it has that share of the overall crypto market.

View live Bitcoin Dominance Chart ->

How Traders Use Dominance

Bitcoin Dominance is often used by traders to gage the current state of the crypto market.

When Bitcoin Dominance is high, it usually means that alt coins are low.

When Bitcoin dominance is low, it usually means the market is overheated since alt coins are at higher prices, which is usually the sign of a bubble.

View live Bitcoin Dominance Chart ->

Concerns with the Metric

The main critique of the Bitcoin dominance metric is that it includes stable coins. Stablecoins are cryptocurrencies that are pegged to government currencies, like the euro or US dollar.

Since stable coins are not really unique coins but simply digital representation of fiat currencies, many believe that stable coins should be removed from the dominance metric.

Where to View Bitcoin Dominance

The most popular places to check the Bitcoin Dominance metric are:

Bitbo - Bitbo is the best place to view the Bitcoin Dominance metric. Bitbo shows the Bitcoin Dominance metric without stable coins. View the live chart here.

CoinMarketcap - Coinmarketcap was the first site to ever publish the Bitcoin dominance metric. Coinmarketcap’s chart includes stable coins in the calculation.

Tradingview - Tradingview has great charts that show Bitcoin dominance with and without stable coins.