Bitcoin Block Size Debate Wars Explained

The Bitcoin block size wars created one of the most intense times in Bitcoin’s history.

Let’s take a look at:

- The history of the block-size debate

- The two sides of the debate

- The debate process

- The result

Key Takeaways

- The Bitcoin block-size debate was between small blockers and big blockers.

- Big blockers wanted to increase the block size limit to increase Bitcoin transaction capacity.

- Small blockers wanted to keep the block size small to ensure Bitcoin's security and decentralization.

What is the Block Size Debate?

The block size debate is about one parameter of the Bitcoin protocol:

The Bitcoin block size limit, which started at 1 megabyte (1MB).

Bitcoin’s ability to process transactions is determined by data size, not amount of transactions. Therefore, increasing the block size data limit would allow the Bitcoin network to process more transactions.

The Two Sides of The Debate

One group (big blockers) wanted to raise the data size limit, arguing that this would allow Bitcoin to process more transactions.

The other group (small blockers) wanted to keep the limit at 1MB or raise the block size through other means such as Segwit.

Reasons Behind Each Side

Big blockers (the group in favor of raising the block size) main argument was that Bitcoin needs to raise the block size to be able to process more transactions.

The group against raising the block size (small blockers) was in favor of using Segwit to increase the block size because it would only require a soft fork and not a hard fork. A soft fork means that old nodes are still compatible with new versions of the software.

The big blockers wanted to simply switch the parameter in Bitcoin’s code from 1MB to 2MB or 8MB. The issue with this approach is that it would force a hard fork, meaning users running old Bitcoin software would be split off from the network.

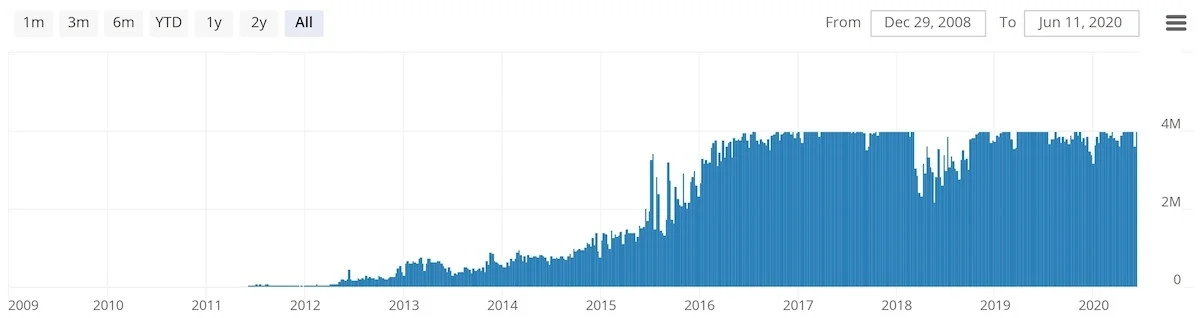

SegWit doubled the transaction capacity of the Bitcoin network. While a lot of people claimed that SegWit did not increase the block size, it’s very easy to see that, yes, SegWit was a block size increase!

Here, for example, we can see a 2,177 KB (2.17 MB) Bitcoin block mined in January 2018.

The Block Size Debate Kicks Off

Bitcoin XT kicked off the block size debate and was the first unsuccessful hard fork of Bitcoin.

Led by Bitcoin developers Gavin Andresen and Mike Hearn, XT attempted to raise the Bitcoin block size to 8 MB.

Despite support from a few large Bitcoin companies, the proposal failed to gain enough support from the community and Bitcoin users.

Frustrated with the lack of support for XT, Hearn labeled Bitcoin a failure, quit working on the project, and sold all of his bitcoins in January 2016.

The launch of XT was covered heavily in the media but still failed to catch hold.

Bitcoin Classic

Bitcoin Classic was the second failed attempt to change Bitcoin’s block size. It attempted to raise the block size from 1MB to 2MB.

The Bitcoin Classic proposal gained support from a few Bitcoin companies and a few mining pools.

Like Bitcoin XT, a lack of support for the proposal among the Bitcoin community as a whole led to the failure of this hard fork attempt.

The New York Agreement

The New York Agreement was a solution proposed by over 50+ Bitcoin companies and miners.

The proposal was simple:

Activate Segwit, and then raise the block size. This would have put Bitcoin’s block size at around 4MB due to Segwit doubling the capacity to around 2MB. Doubling that 2MB would give a 4MB block size limit.

The proposal was led by Digital Currency Group:

UASF Launches

Bitcoin users were not happy bout the New York Agreement proposal. They saw it as a corporate takeover attempt by the largest Bitcoin companies.

This went against Bitcoin’s core values of decentralization.

The thinking was:

If these 50 companies could influence changes related to block size, imagine what else they could try to change in the future!

Bitcoin developer Luke Dashjr launched UASF in March 2017 and set the date of the SegWit activation for August 1, 2017.

The idea was simple:

Give Bitcoin node users the ability to signal their intention to start supporting Segwit.

This put pressure on miners and the companies in the New York Agreement.

Eventually, a compromise was created by developer James Hilliard.

Hilliard created BIP91, which attempted to conciliate the two groups and focus on the key target that they both had in common: the activation of SegWit.

Instead of users activating Segwit as set out in the UASF, BIP91 would allow miners to signal for Segwit and activate it early.

And this is exactly what happened.

Overall, the UASF helped put pressure on miners and companies to activate Segwit.

August 1st is now known as “Bitcoin Independence Day” and is celebrated yearly by Bitcoiners.

Bitcoin Cash

The big blockers were still displeased. Even though Segwit increased the block size, they wanted a larger block size increase.

This led to the creation of Bitcoin Cash (BCH), sometimes referred to as Bcash.

Bitcoin Cash launched on August 1, 2017.

Conclusion

UASF essentially marked the end of the Bitcoin block size debate.

The UASF activated Segwit, which increased the block size by more than double. Once Segwit was activated, there were no more proposals like Bitcoin XT, Bitcoin Classic, or the New York Agreement.

The UASF allowed Bitcoin to raise the block size without kicking old Bitcoin software off the network.

Had the block size been raised through a hard fork, old Bitcoin software would not have worked with the network with the larger blocks.

The block size debate is an interesting show of Bitcoin’s resilience to corporate takeovers and large entity control.

It showed that really, the power is in the users’ hands.