What is the Crypto Fear & Greed Index?

Ever wondered how to gauge the mood of the crypto market?

Enter the Fear & Greed Index.

It’s like a mood ring for the crypto world, giving us a peek into whether investors are feeling scared or greedy.

What is the Bitcoin Fear & Greed Index?

Think of the Bitcoin Fear & Greed Index as a thermometer for market emotions.

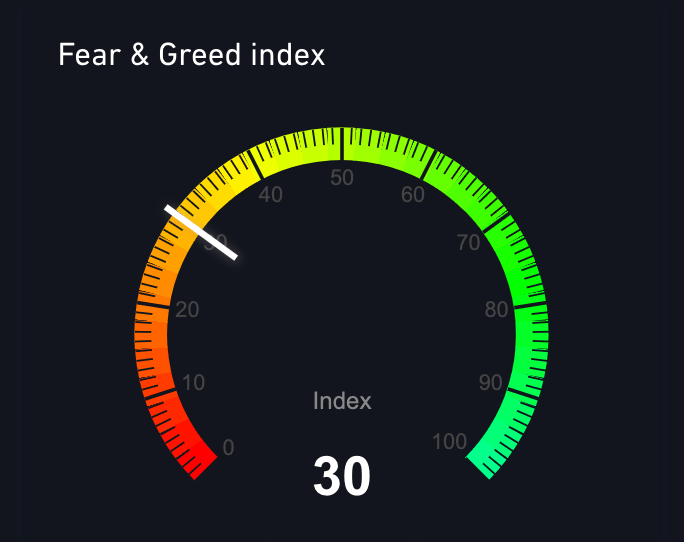

It gives us a score from 0 to 100, where 0 means everyone’s panicking, and 100 means folks are getting a bit too excited.

This index looks at things like market ups and downs, trading volumes, and what people are saying on social media to figure out if fear or greed is running the show.

How is the Bitcoin Fear & Greed Index Calculated?

Volatility

Volatility makes up about 25% of the index.

When Bitcoin’s price is moving up and down a lot, it usually means people are nervous. The index compares today’s craziness with how things were over the past month or three.

Market Momentum/Volume

This part’s also worth about 25% of the index.

It’s all about how much Bitcoin is changing hands.

If everyone’s buying like there’s no tomorrow, the index thinks people might be getting a bit greedy.

If trading’s slower than a snail, it might mean folks are scared to make a move.

Social Media Sentiment

What’s the buzz on Twitter and Reddit?

That’s what this part (about 15% of the index) tries to figure out.

If everyone’s tweeting about how Bitcoin’s going to the moon, the index thinks greed might be creeping in.

Dominance & Trends

Bitcoin’s market share and how often people are Googling about it make up the last 20%.

If Bitcoin’s taking up more of the crypto market pie, it might mean people are playing it safe.

And if “Bitcoin” is trending on Google, well, something’s definitely up.

How to Interpret the Bitcoin Fear & Greed Index

Here’s the cheat sheet:

- 0-24: Panic stations! (But maybe a good time to buy?)

- 25-46: Folks are worried

- 47-54: Meh, no one’s too fussed

- 55-75: People are getting excited

- 76-100: Party time! (But watch out for the hangover)

Remember when COVID-19 hit in March 2020? The index went into full panic mode.

But guess what?

Bitcoin prices shot up after that.

It’s not always right, but it’s a pretty interesting pattern to watch.

Using the Bitcoin Fear & Greed Index for Trading Decisions

Some traders use this index like a contrarian’s compass.

When everyone’s scared, they think about buying.

When everyone’s popping champagne, they consider selling.

Video

The video below explains a bit about the Fear & Greed Index from Bitbo, and how to also view its historical numbers:

Conclusion

The Bitcoin Fear & Greed Index is like a mood ring for the crypto market.

It helps us understand if investors are feeling jittery or jubilant.

By looking at market swings, trading volumes, and social media chatter, it gives us a snapshot of what’s driving Bitcoin prices.

Just remember, it’s one tool in your toolkit – use it wisely!