What is GBTC? How Does it Work?

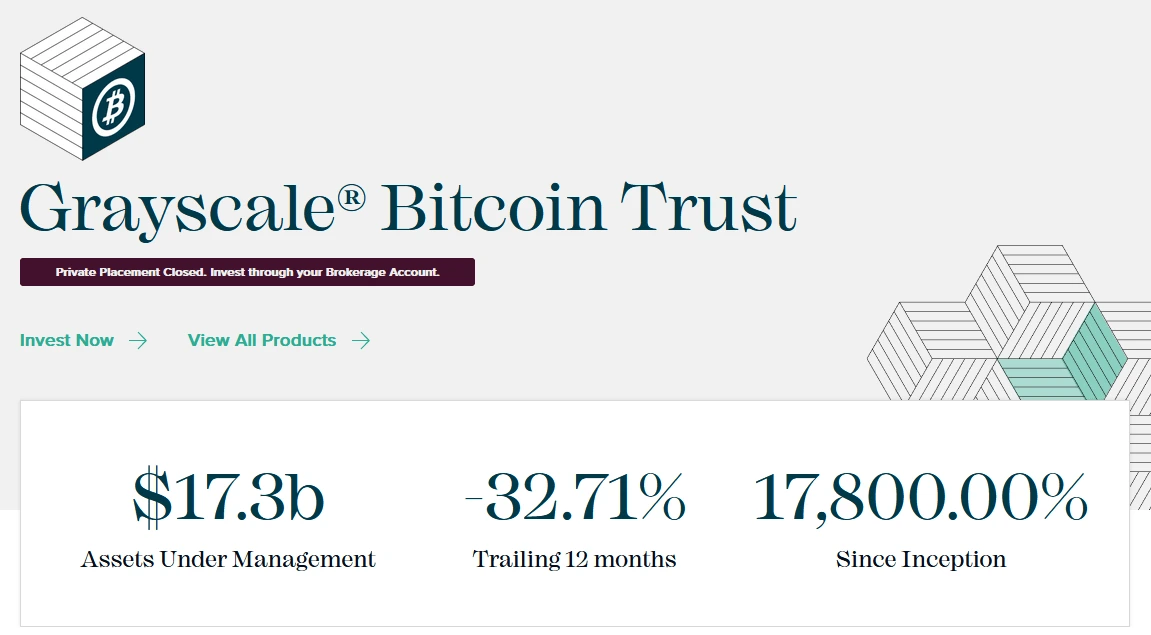

Grayscale Bitcoin Trust (GBTC) has become increasingly popular among investors looking to gain exposure to Bitcoin without directly owning or managing digital assets.

Established in 2013, GBTC is a digital currency investment product that allows individuals and institutions to buy shares representing partial ownership in the trust.

Key Takeaways

- GBTC allows you to invest in Bitcoin via traditional methods.

- The fund charges a yearly 2% fee, making it expensive to own compared to Bitcoin.

- GBTC currently owns over 600,000 BTC.

In this article, we’ll everything from what GBTC is, how it works, and its advantages and disadvantages.

GBTC Overview

| Feature | Description |

|---|---|

| What is GBTC? | An investment product that allows investors to gain exposure to Bitcoin without directly owning or managing it. |

| How Does GBTC Work? | Grayscale Investments purchases and stores Bitcoin on behalf of investors, with each share representing a fraction of a Bitcoin. |

| Advantages |

|

| Disadvantages |

|

What is Grayscale Bitcoin Trust (GBTC)?

Grayscale Bitcoin Trust is an investment product created by Grayscale Investments, a digital currency asset management firm.

Grayscale is a subsidiary of Barry Silbert’s Digital Currency Group. More on them Later.

GBTC provides a convenient way for investors to gain exposure to Bitcoin without the challenges and user risks typically associated with buying, storing, and managing Bitcoin directly.

Instead of purchasing Bitcoin themselves, investors buy shares in the trust, which holds a large pool of Bitcoin.

Each share represents a portion of the Bitcoin owned by the trust. As of this writing, one share of GBTC represents 0.00090698 BTC.

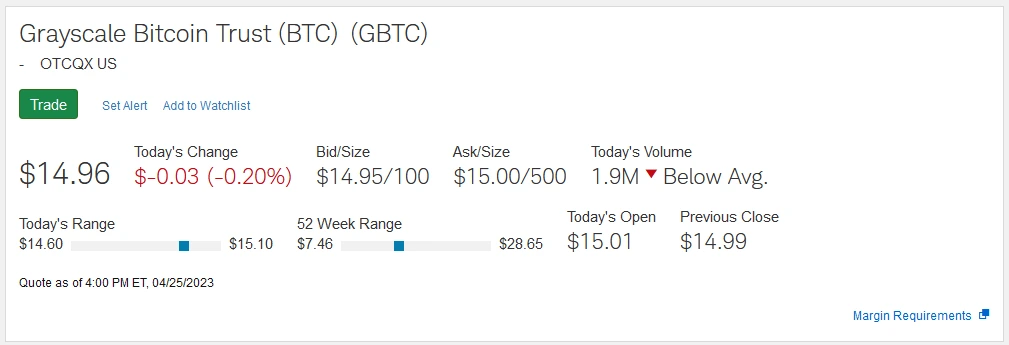

GBTC is traded on the over-the-counter (OTC) market, and quoted on the OTCQX® Best Market, making it accessible to a wide range of investors, including individuals, institutional investors, and even retirement accounts like 401k’s and IRAs.

Currently, the trust owns around 220,000 BTC.

How Does GBTC Work?

Grayscale Investments purchases and stores Bitcoin on behalf of its investors.

- GBTC Overview

- What is Grayscale Bitcoin Trust (GBTC)?

- How Does GBTC Work?

- Advantages of GBTC

- Accessibility

- Custody

- Regulatory Compliance

- Diversification

- Discount to Bitcoin

- Disadvantages of GBTC

- Management Fees

- Higher Risk of Fraud

- Conclusion

- Sources

Due to the regulatory environment that GBTC is supervised under, Grayscale is supposed to follow certain rules to ensure the safety of the assets under management.

However, just because they are supposed to follow the rules doesn’t mean they necessarily always will. More on that in a later section.

Continuing…the total value of the Bitcoin held by GBTC is divided into shares, with each share representing a fraction of a Bitcoin.

The “fair price” of each share is determined by the net asset value (NAV) of the trust, which is calculated by dividing the total market value of the Bitcoin held by the trust by the number of outstanding shares.

The NAV is updated daily, reflecting the changes in the value of Bitcoin.

Keep in mind that the “fair value” is not the same as the market value, which is what you will pay.

The market price of a GBTC share is determined by supply and demand forces in the over-the-counter (OTC) market, where GBTC shares are traded.

As a result, the market price of a GBTC share can deviate from its NAV.

When the demand for GBTC shares is high, investors may be willing to pay more for a share than its NAV, leading to a premium.

Conversely, if the demand for GBTC shares is low, the market price may fall below its NAV, leading to a discount.

This difference can appear in periods when GBTC shares trade at a premium or discount relative to the underlying value of the Bitcoin held by the trust.

There are many reasons the NAV and the price will not be equal, for instance if there are fears that Grayscale does not actually have the Bitcoin they claim to have. In that case, the market price would fall below the NAV.

Now that we have a good understanding of what GBTC is and how it works, let’s discuss some of its pros and cons.

Keep in mind that depending on what kind of investor you are, some the pros may be cons to you, while some of the cons may be pros. It all depends on what features you are looking for out of your bitcoin investment.

Advantages of GBTC

Now let’s go over some of the features of GBTC that make it stand out.

Accessibility

GBTC is traded on the OTC market, allowing investors to buy and sell shares through traditional brokerage accounts.

This makes it an accessible option for those who may not have experience with digital asset exchanges or wallets or who want to invest IRA or 401k money into Bitcoin.

You can even purchase it with apps like Robinhood.

Custody

Grayscale Investments is responsible for the storage and management of the Bitcoin held in the trust.

If storing Bitcoin yourself is intimidating to you, then a product like GBTC may be a good option for you.

Regulatory Compliance

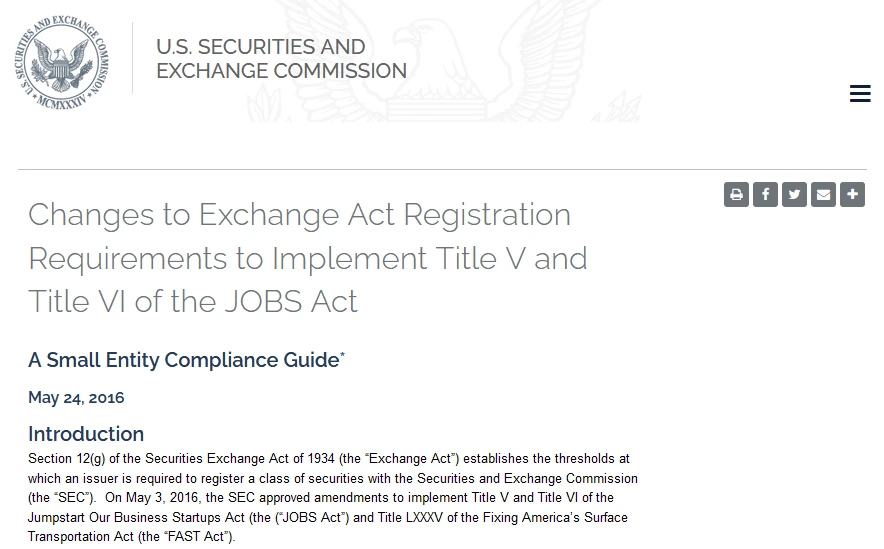

GBTC is regulated by Section 12(g) of the Securities Exchange Act of 1934(4), which sets forth certain rules and guidelines for how assets in the trust should be handled by it.

Diversification

Investors can use GBTC as a means to diversify their portfolios, adding exposure to digital currencies without directly investing in the underlying asset.

Discount to Bitcoin

Perhaps the most appealing part of GBTC is its steep discount to the price of Bitcoin (~40%). If Grayscale actually has possession of as much Bitcoin as it claims AND is ever able to get a proper ETF approved by the SEC, then investors may see big returns.

But that day may yet come, as a court recently sided with Grayscale, striking down the SEC’s logic for denial and forcing them to reconsider.

Disadvantages of GBTC

For all its pros, GBTC is not without its drawbacks, so let’s look at some of those now.

Management Fees

Grayscale Investments charges an annual management fee of 2% for GBTC, which can be higher than fees associated with other investment products or direct ownership of Bitcoin.

Higher Risk of Fraud

As mentioned previously, just because a company is supposed to follow the rules doesn’t mean they will. When you buy GBTC you must trust Grayscale to be honest about the amount of Bitcoin it holds.

When you hold Bitcoin directly, you do not need to trust anyone. This is, in large part, the entire point of Bitcoin.

If you want someone else to hold your Bitcoin because you don’t trust yourself to custody it properly, make sure you can really trust the custodian.

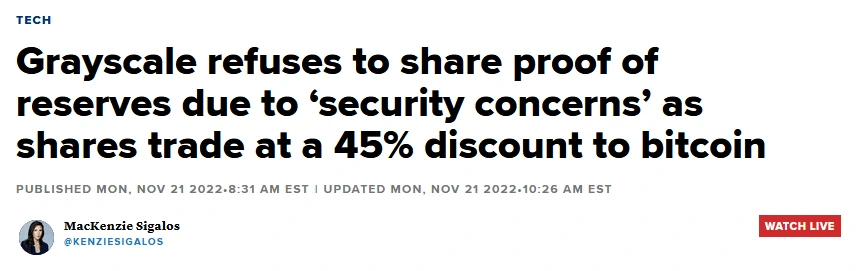

Grayscale has recently displayed disconcerting behavior on this very question.

First, in the wake of the FTX collapse, Grayscale refused to release a proof-of-reserves on their own deposits, citing security concerns

This was a strange reason not to release a proof-of-reserves when doing so is not at all risky and many other custodians chose to release one to alleviate customer fears.

This was made even more concerning when it came to light that Digital Currency Group, Grayscale’s parent company, admitted to losing billions of dollars when Three Arrows Capital collapsed.

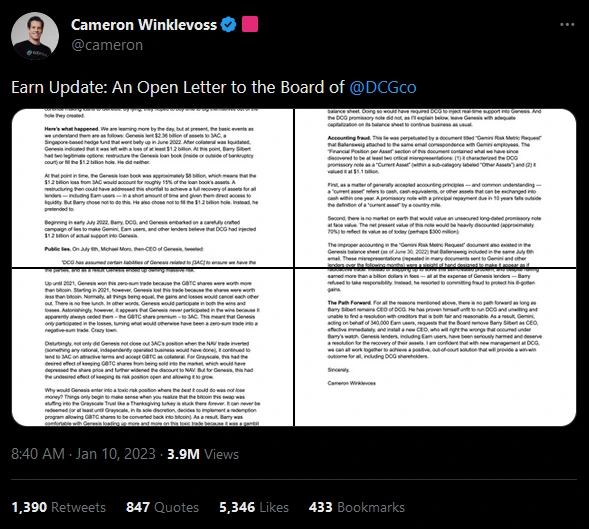

One concerned voice was Cameron Winklevoss, who’s Gemini Exchange was affected by DCG’s exposure(8).

This led many to wonder if DCG used Grayscale funds to shore up its books in the wake of that collapse.

Conclusion

Grayscale Bitcoin Trust offers a well-known and accessible way for investors to gain exposure to Bitcoin without the challenges and technical expertise needed for direct ownership of Bitcoin.

Sources

-

U.S. Securities and Exchange Commission - Section 12(g) of the Securities Exchange Act of 1934

-

Wall Street Journal - SEC Rejects Grayscale Attempt to Turn Bitcoin Fund Into ETF

-

Reuters - US court says SEC wrong to deny Grayscale’s spot bitcoin ETF proposal

-

Cameron Winklevoss via Twitter - An Open Letter to the Board of Digital Currency Group